Assemblymember Phil Ting announces expanding changes including higher income eligibility limit, and self-employed worker qualification

With the tax filing deadline a few days away, qualifying Californians are being urged to claim money through the California Earned Income Tax Credit (CalEITC) program, which puts money back into the pockets of low-income California families and individuals.

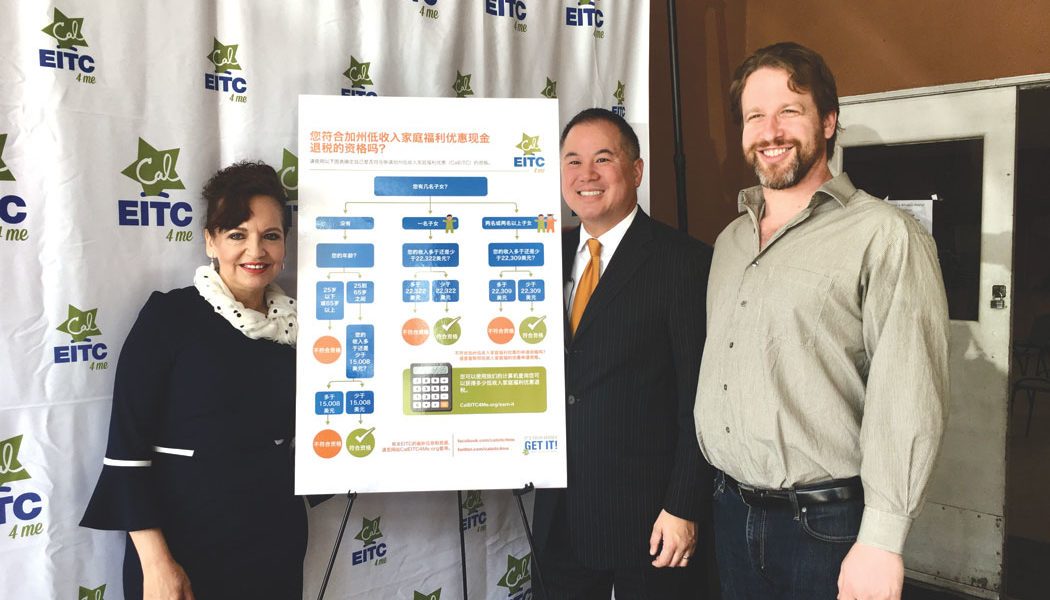

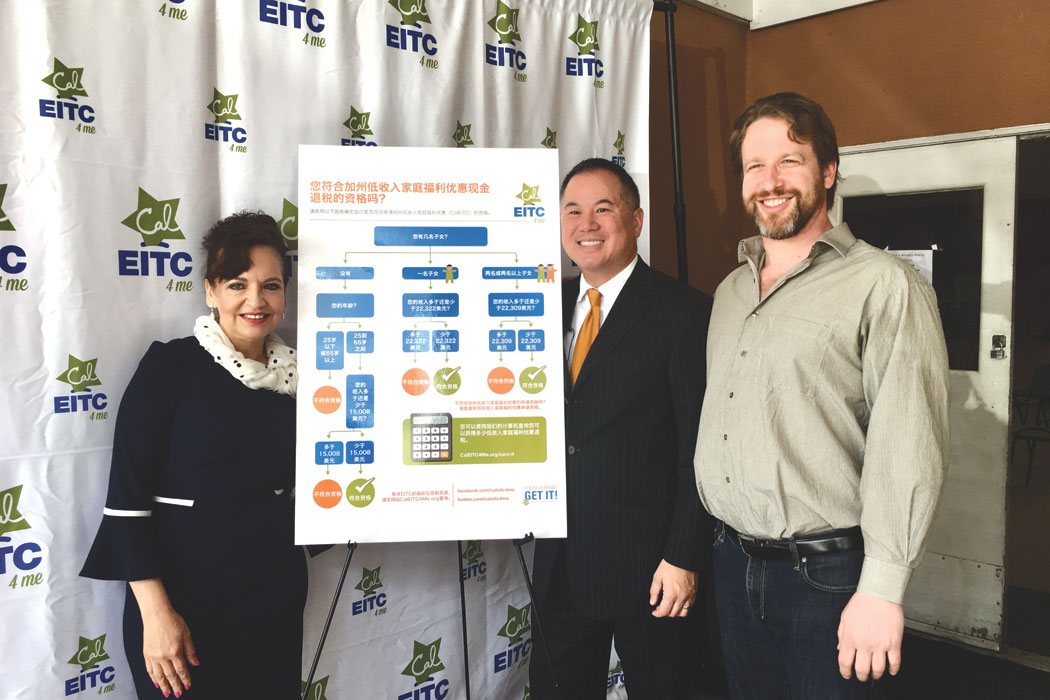

At the Eastmont Community Center in Los Angeles, Assemblymember Phil Ting (D-San Francisco) on Friday, April 13, shared with community members, changes to the program that now allow for more people to be qualified.

“What is so important is that we expanded this tax credit to more people this year,” said Ting, chair of the Budget Assembly Committee, who worked hard last year to expand the program. “It used to be that the income limit was $14,000 — now it’s $22,000.”

Ting shared that self-employed Californians also now qualify for the earned income tax credit.

He also urged people to file their taxes, even after the Tuesday, April 17 deadline.

“Some programs are like if you miss the deadline, too bad. That’s not the case for this one,” said Ting.

California Earned Income Tax Credit (CalEITC) is a cash back tax credit that gives money back to the state’s working families and individuals, and is modeled after the federal EITC enacted in 1975.

According to CalEITC4Me, which hosted the Friday outreach event, California workers have missed out on over $2 billion with the federal and state EITCs. With the expansion of the new CalEITC, even more money is said to be available this tax season. Using both the state and federal EITC can yield beneficial returns.

According to a California Budget and Policy Center survey, fewer than one in five eligible people have even heard of the program. Ting further pointed out that many people with low earnings often avoid paying taxes.

“A lot of people, because they feel like they don’t make that much money, they don’t have to file their taxes. They’re losing the opportunity to get thousands and thousands of dollars,” said Ting.

“That money right now is sitting in Sacramento, but really that money should be sitting in your bank account. That money is meant for you and that is why we are here — to really spread the word,” he added.

CalEITC debuted in 2015 and resulted in more than 385,000 Californians receiving new credit of over $200 million in refunds.

Through March 31, 2018, the state Franchise Tax Board shows that 919,971 Californians have claimed CalEITC — a huge increase from the total 381,588 for last year.

Josh Fryday, president of CalEITC4Me told the Asian Journal that a little over 1.5 million people are eligible. As of April 7, $250 million have already been given out, he added.

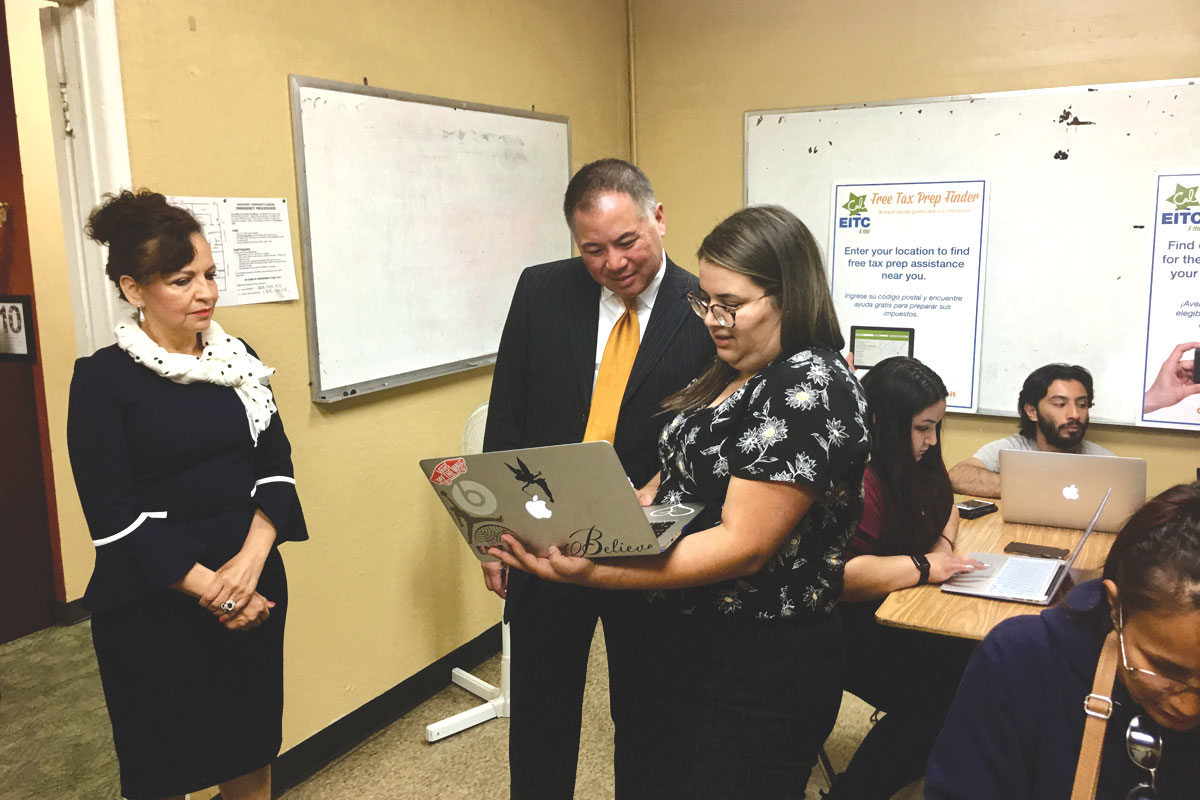

At the Eastmont Community Center, around 350 people from the community have already filed their taxes with the help of CalEITC4Me. Touring the center’s facility, Ting was able to meet some of the community volunteers and members working on outreach efforts like the new multi-lingual CalEITC4Me Calculator. The easy to use tool allows individuals to determine if they’re eligible for CalEITC and federal EITC, and see their potential refund.

“We saw an improvement and increase here, and we’re hoping the money that they receive, they benefit our community,” Teresa Pacios, executive director at the center, told the Asian Journal.

“This is a situation where the state and the IRS owe you money. So they’re going to give you money back,” said Ting. “All you have to do is make sure that you turn in your taxes.”

More information on qualifications and how to claim CalEITC can be found on CalEITC4Me.org. (Rae Ann Varona / AJPress)

If I am retired with pal SS income less than the maximum, am I entitled to file for CalEITC?